Benchmark Investments Introduces Data & Infrastructure Real Estate SCTR Index as Basis for New SRVR ETF

SRVR Index Consists of Top US Companies That Generate the Majority of Their Profits From Real Estate Operations in the Data and Infrastructure Sector

New York, NY — May 15, 2018 – Benchmark Investments, a leading investment intelligence firm, today announced the launch of the Real Estate SCTRSM Index Series. The series is designed to give direct real estate exposure by providing a daily measure of real estate equity level returns on a sector-by-sector basis including the data and infrastructure real estate sector.

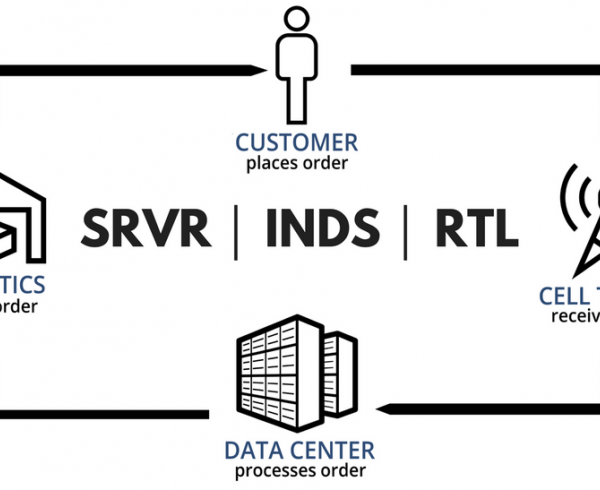

Pacer ETFs has licensed the Benchmark Data & Infrastructure Real Estate SCTRSM Index (SRVRSCTR) to form the basis for a new ETF launching tomorrow trading on the NYSE Arca under the ticker SRVR. The SRVR index aims to provide an additional way of managing real estate exposure to companies that primarily are engaged in data storage and information management, data centers, fiber cables, wireless infrastructure, telecommunications towers, and diversified government solutions.

“The Data & Infrastructure Index, SRVR, was created specifically to capture the returns of the proliferation of computing devices that permeates every aspect of our lives embodied by the demand for data, software and services within the safety of a real estate platform,” said Kevin Kelly, Benchmark Founder and Managing Partner. “SRVR constituents are the foundation for disruptive technologies such as streaming, artificial intelligence, automation, blockchain and predictive analysis as people’s lives have only just begun to see the possibilities when it comes to the interconnection between cameras, phones, cars and ‘internet of things’ devices. Cisco predicts that 50 billion ‘things’ will be connected to the cloud by the end of the next decade and Benchmark’s SRVR Index captures the backbone of that demand.”

“If the market thinks the internet and cloud computing was a boom for data center and cell tower companies, just wait until the ‘Future Four Horsemen’ of Artificial Intelligence, Virtual Reality, Block Chain (Distributed Ledgers), and the Internet-of-Things are unleashed over the next 10, 20, and 30 years,” said Kevin R. Kelly, CEO & Managing Partner of Benchmark Investments.

Benchmark Real Estate SCTRSM Indexes can serve as the basis for exchange traded funds (ETFs) and institutional asset mandates. The Real Estate indexes also provide valuable daily insights for developers, brokers, lenders and others who need to monitor the pulse of the real estate market to see how property sectors are evolving.

About Benchmark: Benchmark is an investment intelligence firm that delivers innovative solutions to help solve complex portfolio challenges for the evolving needs of investors across asset classes. Real estate, equity, and option market participants rely on our independent data and analytics to implement their precise market view relevant to their investment process. Benchmark’s indexes can be used as versatile tools to support active portfolio management by integrating into critical functions like risk, volatility and liquidity management. Benchmark’s index based innovations power investment products and strategies for some of the top leading firms including its franchise Real Estate SCTR℠ series.

# # #

Media Contact:

Krista Kelly

Benchmark Investments

+1 (212) 951-0840

newsroom@wordpress-649497-3135215.cloudwaysapps.com

Disclaimer:

The information in this document does not constitute tax, legal or investment advice and is not intended as a recommendation for buying or selling securities. Benchmark Investments LLC and all other companies mentioned in this document are not responsible for the consequences of reliance upon any opinion or statement contained herein or for any omission. Benchmark is not acting as an investment adviser, investment fiduciary, broker, dealer or other market participant, and no offer or solicitation to buy or sell any security or real estate investment is being made.

This information is solely educational in nature. Indices cannot be invested in directly. Inclusion of a security in an index is not a recommendation to buy, sell or hold such security. Index returns do not represent the results of the actual trading of investable assets. Performance results are provided only as a barometer or measure of past performance, and future values will fluctuate from those used in the underlying data. Any investment returns or performance data (past, hypothetical or otherwise) shown herein or in such data are not necessarily indicative of future returns or performance