Benchmark Introduces Industrial Real Estate SCTR Index as Basis for New INDS ETF

INDS Index Consists of Top US Companies that Generate the Majority of Their Profits From Real Estate Operations in the Industrial Sector

New York, NY — May 15, 2018 – Benchmark Investments, a leading investment intelligence firm, today announced the launch of the Real Estate SCTRSM Index Series. The series is designed to give direct real estate exposure by providing a daily measure of real estate equity level returns on a sector-by-sector basis including the industrial real estate sector.

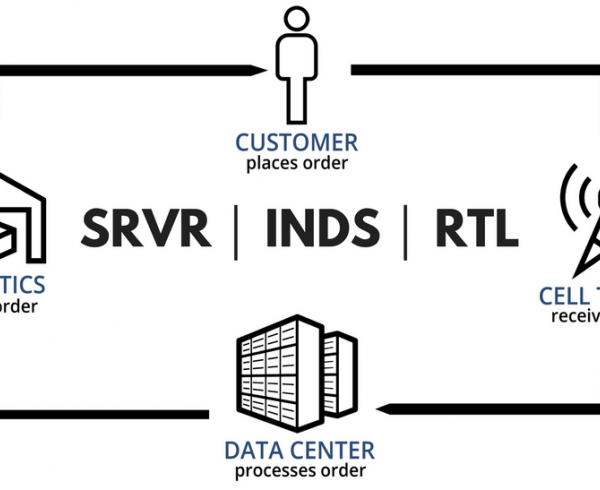

Pacer ETFs has licensed the Benchmark Industrial Real Estate SCTRSM Index (INDSSCTR) to form the basis for a new ETF launching today trading on the NYSE Arca under the ticker INDS. The INDS index aims to provide an additional way of managing real estate exposure to companies that primarily focus on owning and managing industrial properties including warehouse, distribution, industrial and storage facilities.

“Benchmark Industrial Real Estate Index constituents are experiencing astonishing market rent growth driven by the demand for distribution centers needed to feed the e-commerce beast. We are excited to provide investors an efficient way to capitalize on the ‘Industrial Revolution 2.0’ because of e-commerce’s growing dominance,” said Benchmark CEO and Managing Partner Kevin R. Kelly. “Benchmark cannot be more pleased that Pacer ETFs has decided to use the indexes as the basis for a new suite of ETFs including the INDSSCTR.”

The shift toward online shopping has increased the need for warehouse space by retailers seeking to expand their digital operations and cut delivery times even with shopping at Amazon.com Inc. and other internet retailers only accounting for less than 10 percent of retail sales in the United States. Purchases of industrial buildings surged 34 percent in the first quarter from a year earlier to $20.9 billion, according to research firm Real Capital Analytics Inc.

“One major benefit of Industrial REITs is they’ve been expanding their portfolios to satisfy the strong warehouse demand for years, positioning themselves near, or around, high-population cities where the entitlement process can take significant time and consideration,” said Kevin R. Kelly, Managing Partner and Founder of Benchmark Investments.

Benchmark Real Estate SCTRSM Indexes can serve as the basis for exchange traded funds (ETFs) and institutional asset mandates. The Real Estate indexes also provide valuable daily insights for developers, brokers, lenders and others who need to monitor the pulse of the real estate market to see how property sectors are evolving.

About Benchmark: Benchmark is an investment intelligence firm that delivers innovative solutions to help solve complex portfolio challenges for the evolving needs of investors across asset classes. Real estate, equity, and option market participants rely on our independent data and analytics to implement their precise market view relevant to their investment process. Benchmark’s indexes can be used as versatile tools to support active portfolio management by integrating into critical functions like risk, volatility and liquidity management. Benchmark’s index based innovations power investment products and strategies for some of the top leading firms including its franchise Real Estate SCTR℠ series.

# # #

Media Contact:

Krista Kelly

Benchmark Investments

+1 (212) 951-0840

newsroom@wordpress-649497-3135215.cloudwaysapps.com

Disclaimer:

The information in this document does not constitute tax, legal or investment advice and is not intended as a recommendation for buying or selling securities. Benchmark Investments LLC and all other companies mentioned in this document are not responsible for the consequences of reliance upon any opinion or statement contained herein or for any omission. Benchmark is not acting as an investment adviser, investment fiduciary, broker, dealer or other market participant, and no offer or solicitation to buy or sell any security or real estate investment is being made.

This information is solely educational in nature. Indices cannot be invested in directly. Inclusion of a security in an index is not a recommendation to buy, sell or hold such security. Index returns do not represent the results of the actual trading of investable assets. Performance results are provided only as a barometer or measure of past performance, and future values will fluctuate from those used in the underlying data. Any investment returns or performance data (past, hypothetical or otherwise) shown herein or in such data are not necessarily indicative of future returns or performance