- Kimco Realty (KIM) is a constituent of the RTL Index

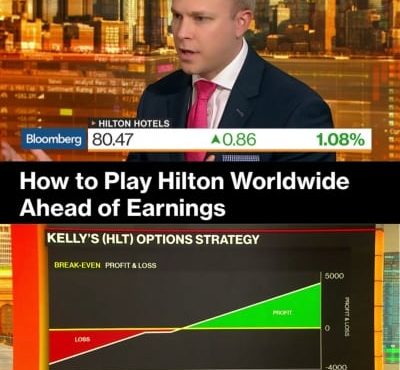

- Trade: Covered Call

- Buy KIM at $13.90

- Sell the Kimco July 20 $15 Call for $0.25

- Dividend yield is 8%

- Options Yield of 1.8%

Kevin Kelly, managing partner at Benchmark, discusses Amazon’s effect on retail and his options trade for Kimco Realty with Julie Hyman on “Bloomberg Markets.” (Source: Bloomberg)

Kimco Realty Corp. (NYSE: KIM) is a real estate investment trust (REIT) that is one of the largest publicly traded owners and operators of open-air shopping centers. The company owned interests in 475 U.S. shopping centers comprising 81 million square feet of leasable space primarily concentrated in the top major metropolitan markets. Publicly traded on the NYSE since 1991, and included in the S&P 500 Index, the company has specialized in shopping center acquisitions, development and management for 60 years.