- What are the benefits of publicly traded real estate?

- Real estate securities provide the benefits of owning institutional commercial real estate without requiring investors to commit large amounts of capital.

- Correlation and risk-adjusted return metrics demonstrate that listed equity real estate investment trusts provide optimal exposure to the real estate asset class.

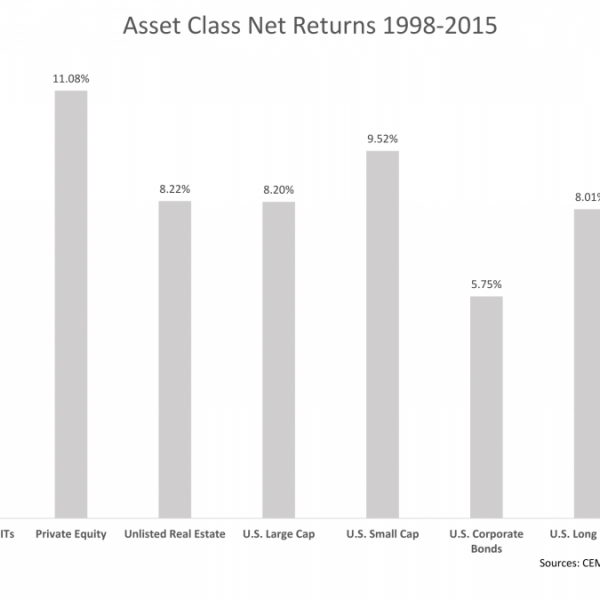

- 1998 to 2015, REITs had the highest average annual net return, relatively low correlations with other asset classes, implying good diversification benefits, and strong risk adjusted returns.

Intro:

CEM Benchmarking used its unique proprietary dataset which is comprised of asset level return data for hundreds of U.S. pension funds with more than $3 trillion in assets. The CEM analysis concluded that over the 18-year period of study covering the years 1998 to 2015, REITs had the highest average annual net return, relatively low correlations with other asset classes, implying good diversification benefits, and strong risk adjusted returns.

Background:

Nareit sponsored an 18-year study performed by CEM Benchmarking that reveals allocations, returns, volatility and risk-adjusted performance of 12 asset classes. The results provides a comprehensive look at realized investment performance across asset classes over an 18-year period using a proprietary dataset covering more than 200 public and private sector pensions with nearly $3.5 trillion in combined assets under management.

One of the unique benefits of the CEM dataset is that it provides the actual realized performance net of investment costs of the assets chosen by plan managers and trustees.

The study compares gross and net average annual total returns as well as correlations and volatilities for 12 asset classes with appropriate adjustments for reporting lags associated with illiquid asset classes (unlisted real estate and private equity).

Returns

Over the 18-year period covered by the study there are striking differences in performance across asset classes. The chart below summarizes average annual net returns and expenses for the 12 asset classes.

- Listed equity REITs had the highest average net return over the period, averaging 11.4 percent. Private equity had the highest average gross return, estimated as 13.1 percent, but had the second highest average net return of 11.1 percent because of the impact of expenses.

- Unlisted real estate produced average net returns of 9.3 percent over the period, nearly 20 percent less than REITs.

- The two worst performing asset classes were hedge funds/tactical asset allocation (TAA) strategies and U.S. other fixed income. U.S. other fixed income however includes cash. If cash is excluded from U.S. other fixed income as an aggregate asset class, then hedge funds/TAA would have been the worst performing asset class with an 18-year arithmetic average annual net return of 5.1 percent.

Correlations

The study computed correlations of annual returns among the 12 asset classes. The table below summarizes some key correlations between broad equities, REITs and unlisted real estate.

- As highlighted in green, REIT and unlisted real estate returns were highly correlated when illiquid returns are adjusted for reporting lags. The correlation is measured as .92. The high correlation is not surprising given the similarities in underlying assets.

- As highlighted in dark blue, REIT and unlisted real estate returns had relatively low correlations with listed equity returns. These relatively low correlations reflect the well-known diversification benefits associated with the real estate asset class, whether REITs or unlisted real estate.