- Each property type has its own set of investment characteristics, including individual economic cycles and risk factors, competition threats, and growth potential.

- In today’s marketplace, real estate ownership and operation is as competitive as ever. The fierce competition has led to most real estate companies, including REITs, to specialize in both sector and locations in order to better serve their tenants and shareholders.

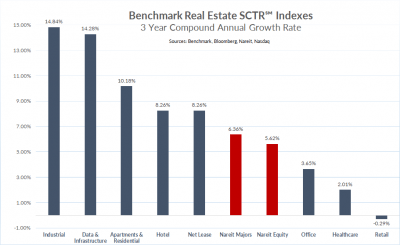

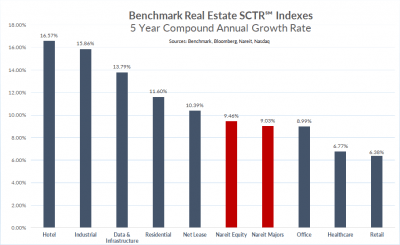

- Conservative real estate investors will be well diversified and seek the best relative performance to avoid those whose market cycles appear to create an unfavorable risk-reward ratio as each sector might, at any particular time, be in a different phase of the broad real estate cycle.

Certain things are true of all commercial properties: their value and profitability depend on property-specific issues, such as location, lease revenues, property expenses, occupancy rates, prevailing market rental rates, tenant quality, and replacement cost; real estate issues such as market “cap rates” and supply/ demand conditions; competition from nearby properties; and such “macro” forces as the economy, employment growth, consumer and business spending, interest rates, and inflation.

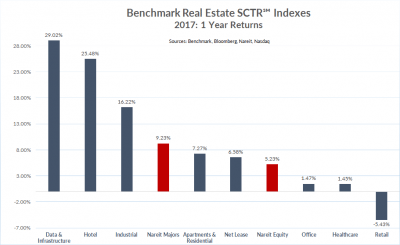

Properties themselves can be quite dissimilar despite generalizations and expectations that can be applied to commercial real estate generally. As exemplified by the 2017 returns of the Real Estate SCTRs℠ indexes, the owners of apartment and residential properties had concerns very different from the owners of retail properties or office buildings.

Real Estate SCTRs℠ provide tailored solutions for commercial real estate investment management. Most publicly traded companies specialize in their respective sector given each property type has its own unique characteristics based on its lease terms, barriers to supply and the factors that drive tenant demand. There is significant dispersion of market multiples (Share Prices/Fund From Operations) and returns throughout the property sectors thereby giving market participants direct access to the property class they desire.